These costs were calculated in 2025, they represent a snapshot of the industry at the time and have not been adjusted since to account for industry developments, commodity pricing or geopolitical events. Therefore, while the broad trends and assumptions used remain relevant, care should be taken if quoting costs directly.

This page contains information about wind farm costs (both as lifetime costs and a detailed cost breakdown) and about levelised cost of energy.

Lifetime costs

The pie chart shows the contribution of each major cost element to levelised cost of energy (LCOE).

The cost is comprised of:

- The capital expenditure (including development expenditure) (CAPEX)

- The cost of finance for that CAPEX

- The operational expenditure (OPEX), and

- The decommissioning expenditure (DECEX)

Levelised cost of energy

LCOE is defined as the revenue required (from whatever source) to earn a rate of return on investment equal to the discount rate (also referred to as the weighted average cost of capital (WACC)) over the life of the wind farm. Tax and inflation are not modelled. In other words, it is the lifetime average cost for the energy produced, quoted in today’s prices.

Purpose of LCOE

LCOE is used to evaluate and compare the cost of electricity production from different technologies and at different locations. It is a good way to compare the cost of a unit of energy (say in pounds per megawatt hour of electricity (£/ MWh)) produced. LCOE also does not consider costs relating to balancing supply and demand.

Lower LCOE benefits the electricity consumer (and tax payers if any subsidy is paid to generators), so decreasing LCOE is a key focus for the offshore wind industry.

LCOE combines costs and energy production into one metric, rather than comparing cost and energy production separately. It is used by technology players and industry enablers, but typically not by project investors who may be more interested in internal rate of return (IRR) or net present value (NPV) of an investment, taking into account more company-specific features like tax.

In the typical case shown in the pie chart above and table below, the LCOE is compatible with the bid prices seen in recent UK Government Contract for Difference (CfD) auctions.

CfD bid price is the revenue (£/ MWh) sought by the developer for a 15 year duration. Revenue after this will come from the open market. The bidder’s prediction of future market prices and its approach to risk and competition will determine how it sets its CfD bid price. The CfD bid price therefore is not equal to LCOE, though there is a relationship between the two. In different markets, the scope of supply of the project developer and the terms of the competition vary, meaning that there is a different relationship between CfD bid price and LCOE.

Definition of LCOE

The technical definition of LCOE is:

Where:

It Investment expenditure in year t

Mt Operation, maintenance and service expenditure in year t

Et Energy generation in years t

r Discount rate (or WACC), and

n Lifetime of the project in years.

Drivers of LCOE

LCOE reduction can come from reduced costs, increased energy production or changes in financing and lifetime of the project. Reduced cost can be from process or technology changes during the manufacturing, installation or operations phase. Increased energy production may be as a result of technology or by reducing lost energy via better operational processes. Reducing project risk is the main way to affect financing cost.

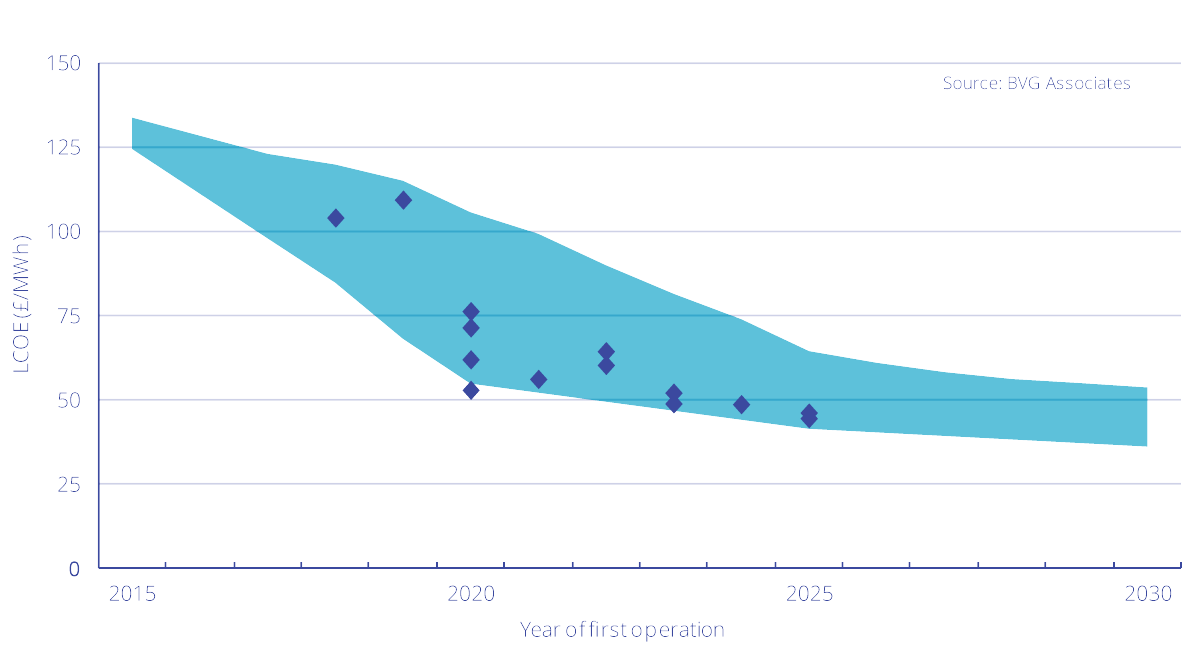

As shown in the chart, LCOE across Europe varies between projects (blue dots) but overall are continuing to reduce significantly over time. The LCOE has been back-calculated based on assumptions of full-life revenue & transmission costs, where applicable, as well as the auction price). The band takes into account range in site conditions and support mechanisms / local requirements that impact LCOE.

Some of the key drivers of cost are:

Site conditions

Typically, projects in deeper water require more expensive foundations and have increased installation cost. Easier ground conditions such as dense sand with low gradients on homogeneous, stiff clay containing few (if any) boulders offer cost benefits as a range of piling solutions can be used and there is high confidence of long-term foundation stability. Other conditions can add significantly to cost by driving a need for alternative designs and installation methods, such as larger diameter monopiles or drilling into rock or through boulders.

Average and storm wind and wave conditions, tidal ranges and tidal flows also impact LCOE. Higher mean wind speeds increase cost, but have a net benefit for LCOE due to increased energy production. In some markets (for example in Asia), typhoon winds drive design changes that add cost. Tidal ranges add to cost due to having to keep a minimum clearance from sea level to blade tip at all times. Tides and waves make it harder to access turbines, especially for unplanned service activities in bad weather, adding cost and reducing energy production.

Likewise, projects further from shore take longer to access, which adds cost and increases downtime, hence reducing energy production. At about 60 km, it may be most cost effective to use a service operation vessel (SOV) spending weeks at sea, rather than crew transfer vessels (CTVs) travelling to and from port daily. Projects further from shore typically also have longer grid connections, adding to transmission CAPEX and OPEX.

Over time, there has been a move by governments from providing an agreed fixed-value market mechanism to support offshore wind to auctions where project developers bid a price for electricity they will generate. This change drives competition at project level which is passed down through the supply chain. Also, as the industry matures, what used to be highly differentiated areas of supply become commodities, driving further competition.

In some areas, such as turbines, the market is not big enough to have more than a handful of suppliers competing globally. This limits competition. In other areas, such as cables and foundations, transport costs are low enough to enable a geographically diverse supply base to bid for supply. In areas such as provision of port services, distance to the wind farm is key, which localises competition.

Vessel charter prices are a good example of the impact of pan-sector competition. Whether considering large floating installation vessels or common tugs, cyclic variations in regional wind and oil and gas activity can have a significant effect of price. Large turbine and foundation jack-up vessels are typically purpose-built for wind, so price volatility depends much more on the pipeline of offshore wind projects.

Supply chain evolution

Over time, the supply chain has matured and larger players have taken on wider scopes and more risk. Wider scope within one supplier has enabled more cross-disciplinary collaboration to reduce cost. Also, larger volumes have facilitated investment in design, manufacturing and installation tooling suited to higher-volume process repetition. Large offshore wind farms may use 100 sets of identical (or similar) components, quite different from the more common practice in oil and gas of constructing one-offs.

Technology development

To date, the biggest driver over time of cost of energy reduction has been the development of new technology. The most visible sign of this has been the increase in turbine rating, increasing from 2 MW turbines 20 years ago to 15 MW turbines for projects being given the go-ahead today. The rate of growth has been extraordinary and has enabled offshore wind projects in some parts of Europe to compete on cost of energy with onshore projects in other parts of Europe.

Larger turbines help drive down the per MW cost of foundations, installation and operation, whilst reaching higher into the wind field, so increasing energy production per MW installed. Larger turbines drive a need for technology development at a component level, as offshore wind turbines use the largest castings, bearings, generators and composite structures in series manufacture in any industry.

Industry incorporation of digital, autonomous, artificial intelligence and other applicable technologies is also enabling significant cost reduction, especially through improved wind farm operation and control.

Costs

Typical costs have been provided based on a project with the following parameters, typical of an upcoming UK offshore wind project.

| Parameter | Data |

|---|---|

| Wind farm rating (MW) | 1000 |

| Wind turbine rating (MW) | 15 |

| Water depth at site (m) | 50 |

| Annual mean wind speed at 100 m height (m/s) | 10 |

| Distance to shore, grid, port (km) | 75 |

| Date of financial investment decision to proceed (FID) | 2027 |

| First operation date | 2030 |

Detailed, bottom-up assessment of this typical project gives the following inputs to the LCOE equation:

- Total CAPEX = £3,470,000/MW (with spend spread realistically over years leading up to first energy production)

- Annual average OPEX = £85,000/MW

- Lifetime = 30 years

- WACC = 6.5%

Net annual average energy production = 4,200 MWh/year/ MW

As discussed above there can be quite a range in prices of any element, due to specific timing or local issues, exchange rates, competition and contracting conditions. Prices for large components include delivery to nearest port to supplier and warranty costs. Developer costs (including internal project- and construction management, insurance, typically spent contingency and overheads) are included in the highest-level boxes but are not itemised.

Cost breakdown

A more detailed breakdown of typical costs is presented in the table below. Note that figures presented are each rounded, hence totals may not equate to the sum of the sub-terms. As discussed above, there can be a large variation in costs between projects, so values stated should only be seen as indicative.

Cost breakdown by category

| Guide category | Costs (2024£ / MW) |

|---|---|

| Development and project management | 155,000 |

| Development and consenting services | 72,300 |

| Environmental impact assessments | 10,700 |

| Development activities and other consenting services | 61,600 |

| Environmental surveys | 8,700 |

| Animal surveys (benthic, fish, shellfish, mammals and birds) | 7,500 |

| Onshore environmental surveys | 1,200 |

| Human impact studies | 770 |

| Resource and metocean assessment | 7,000 |

| Structure | 3,500 |

| Sensors | 900 |

| Maintenance | 660 |

| Geological and hydrographical surveys | 9,400 |

| Geophysical surveys | 2,500 |

| Geotechnical surveys | 5,000 |

| Hydrographic surveys | 1,900 |

| Engineering and consultancy | 9,500 |

| Project management | 48,400 |

| Wind turbine | 1,200,000 |

| Nacelle | 780,000 |

| Rotor | 340,000 |

| Tower | 94,000 |

| Balance of plant | 1,100,000 |

| Array cable | 76,000 |

| Export cable | 270,000 |

| Cable accessories | 36,000 |

| Turbine foundation | 420,000 |

| Monopile | 266,000 |

| Transition piece | 124,000 |

| Corrosion protection | 28,000 |

| Scour protection | 5,400 |

| Offshore substation | 240,000 |

| HVAC electrical system | 79,800 |

| Auxiliary systems | 13,300 |

| Topside structure | 123,200 |

| Foundation | 22,000 |

| Onshore substation | 44,000 |

| Electrical system | 30,800 |

| Buildings, access and security | 13,000 |

| Installation and commissioning | 1,000,000 |

| Inbound transport | 87,000 |

| Foundation installation | 165,000 |

| Monopile installation vessel | 75,000 |

| TP installation vessel | 41,000 |

| Technician services | 1,000 |

| Marshalling port | 10,400 |

| Other | 37,000 |

| Turbine installation | 132,000 |

| Turbine installation vessel | 98,000 |

| Technician services | 7,000 |

| Marshalling port | 9,200 |

| Other | 17,000 |

| Offshore cable installation | 193,000 |

| Onshore export cable installation | 8,400 |

| Offshore substation installation | 43,400 |

| Onshore substation construction | 29,400 |

| Offshore logistics | 13,000 |

| Sea-based support | 6,000 |

| Marine coordination | 2,000 |

| Weather forecasting and metocean data | 600 |

| Marine safety and rescue | 4,400 |

| Contingency and insurance | 343,000 |

| Operation, maintenance and service | 85,000 |

| Operations, maintenance and service port | 400 |

| Operations | 31,000 |

| Operations control centre | 1,300 |

| Training | 2,600 |

| Onshore logistics | 1,300 |

| Technical resource (onshore and off) | 6,600 |

| Admin and support staff (onshore) | 7,900 |

| Insurance | 11,220 |

| Offshore logistics | 7,200 |

| Maintenance and service | 47,000 |

| Turbine maintenance and service | 34,200 |

| Balance of plant maintenance and service | 11,600 |

| Statutory inspections | 1,000 |

| Decommissioning | 426,000 |

| Turbine decommissioning | 105,000 |

| Foundation decommissioning | 132,000 |

| Cable decommissioning | 155,000 |

| Substation decommissioning | 35,000 |